Sole proprietorship is a type of business structure owned and managed by a single individual who is not legally separated from his business which means that he will enjoy all the profits but will have to shoulder all the financial responsibilities such as debts.

Incorporation Services

Sole Proprietorship

-

Minimal compliance.

-

Suitable for small to medium scale business or PT Shops & Commercial Establishment.

-

No registration required, just a Trade License, GST is applicable.

-

Current Account in the name of the Sole Proprietorship.

-

Tax friendly as compared to a Pvt. Ltd. and an LLP.

-

Greater flexibility and ease of operations.

-

Sole Proprietorship is optimal for freelancers as it has minimal compliance and more tax benefits as compared to a Private Limited Company/LLP.

-

MSME Udyam Registration

-

CA Certificate

-

TAN

-

GST Registration

-

Name & Nature of Firm

-

Pan Card

-

Adhar Card

-

Electricity Bill

-

Photo

-

Mobile No & Email Id

-

Bank Account Details

Partnership Firm

A Partnership Firm is a popular form of business constitution for businesses that are owned, managed and controlled by an Association of People for profit.

Partnership firms are relatively easy to start and is prevalent amongst small and medium sized businesses in the unorganized sectors. The document in which the respective rights and obligations of the members of a partnership is written called Partnership Deed.

In India, a partnership is governed by Indian Partnership Act, 1932, and a partnership firm does not have an independent status apart from the partners constituting it. Partnership does not have a legal entity status than of its partners. It has limited identity for the purpose of tax laws. Any two people can start partnership business under an agreement called partnership deed. It is not mandatory to register a partnership deed but it is advisable to register partnership deed but for evidential purpose.

Easy to form

Since a partnership is a relation of two or more people, the formation is very simple. It can be created by an agreement among the partners describing terms and conditions.

Registration

As per the law, registration is not mandatory to start a partnership. However, registration is advisable for evidence if any dispute arises in future.

Flexibility

Easy to manage as no compliance requirements compared to company or LLP form of business.

Sharing of responsibilities

Partners can share the responsibility of partnership and the business. They can also share decision making.

Tax

Compared to company, tax on profit is less in a partnership. Also, no profit distribution tax is applicable to a partnership firm.

Winding Up

Easy to wind-up a partnership firm than a company or LLP as partnership is created by an agreement.

-

Minimal compliance.

-

Suitable for small to medium scale business or PT Shops & Commercial Establishment.

-

Drafting of Partnership Deed.

-

Pan of Partnership.

-

Tan of Partnership .

-

GST Registration.

-

CA Certificate.

-

Name & Nature of Firm

-

Pan Card, Adhar Card & Photo of Partners

-

Objectives of Firm

-

Electricity Bill & Rent agreement of Firm

-

CA Certificate.

One person company (OPC)

A new concept has been introduced in the Company’s Act 2013, about the One Person Company (OPC). In a Private Company, a minimum of 2 Directors and Members are required whereas in a Public Company, a minimum of 3 Directors and a minimum of 7 members. A single person could not incorporate a Company previously.

But now as per Section 2(62) of the Company’s Act 2013, a company can be formed with just 1 Director and 1 member. It is a form of a company where the compliance requirements are lesser than that of a private company.

-

Digital Signature

-

DIN Of Director

-

Filing of Spice form

-

Issue of Incorporation Certificate along with PAN and TAN

-

Includes Govt Fees & Stamp duty for Authorized Capital upto Rs. 1 Lakh except for the states of Punjab, Madhya Pradesh and Kerala

-

Memorandum of Association

-

Articles of Association

-

Provisional PF ESI Registration

-

GST Registration

-

MSME Registration

-

Pan Card of all Directors and Subscribers

-

Identity Proof i.e. Voter Id Card/ Driving License/ Aadhar Card/ Passport of all Directors and Subscribers

-

Filing of Spice form

-

Issue of Incorporation Certificate along with PAN and TAN

-

Address Proof i.e. Bank Statement, Mobile bill, Telephone bill of all Directors and Subscribers

-

Passport Size Photographs of all Directors and Subscribers

-

Current Electric Bill/ Utility Bill as Registered Office Proof

-

Rent Agreement if Applicable

Limited Liability Partnership (LLP)

Partnerships are the most common business structure for businesses that have more than one owner. Many businesses, ranging from retail stores to accounting firms, are structured as partnerships. A business partnership is a for-profit business established and run by two or more individuals. There can be any number of partners involved in the business, as long as there are at least two. A business partner is a co-owner of the business.

Most business partnerships are general partnerships, meaning that all partners have responsibility for the business and unlimited liability for the financial obligations of the business. This means that general partners share both the benefits and the detriments of the business.

However, some types of partnership allow at least one owner limited personal liability for the business' financial obligations, such as debts and court judgments. One common structure is the limited liability partnership, or LLP. A limited liability partnership is a newer form of business partnership where all of the owners have limited personal liability for the financial obligations of the business.

-

Digital Signatures

-

DPIN Of Two Directors

-

Name Search and Approval

-

Filing of Form Fillip along with Pan and Tan

-

LLP Agreement

-

Provisional PF ESI Registration

-

GST Registration

-

MSME Registration

-

Copy of PAN Card of partners

-

Passport size photograph of partners

-

Copy of Aadhaar Card/ Voter identity card/ Driver’s license of Partners

-

Current Bank Statement/ any Utility Bill of Partners

-

Current Electric Bill for Registered Office of Company

-

Passport Size Photograph of all Partners

-

Rent Agreement if Applicable

PRIVATE LIMITED COMPANY

A private limited company, or LTD, is a type of privately held small business entity. This type of business entity limits owner liability to their shares, limits the number of shareholders to 50, and restricts shareholders from publicly trading shares.

-

One of the advantages of private limited company is that members are well known to each other; however control is in the hands of owners of capital.

-

In the management of affairs and conduct of business is greater flexibility.

-

Statutory meeting is not required as well as submitting of a statutory report.

-

The number of directors in a private limited company is at least two.

-

One of the advantages of private limited company is that its limited liability, due to which every member enjoys this facility. It has the advantage of a public company and a partnership firm.

-

A private ltd company after receiving certificate of incorporation can start their business immediately.

-

Digital Signatures

-

DIN of Directors

-

Filing of Spice form

-

Issue of Incorporation Certificate along with PAN and TAN

-

Memorandum of Association

-

Articles of Association

-

Provisional PF ESI Registration

-

GST Registration

-

MSME Registration

-

Pan Card of all Directors and Subscribers

-

Identity Proof i.e. Voter Id Card/ Driving License/ Aadhar Card/ Passport of all Directors and Subscribers

-

Filing of Spice form

-

Issue of Incorporation Certificate along with PAN and TAN

-

Address Proof i.e. Bank Statement, Mobile bill, Telephone bill of all Directors and Subscribers

-

Passport Size Photographs of all Directors and Subscribers

-

Current Electric Bill/ Utility Bill as Registered Office Proof

-

Rent Agreement if Applicable

PUBLIC LIMITED COMPANY

A private limited company, or LTD, is a type of privately held small business entity. This type of business entity limits owner liability to their shares, limits the number of shareholders to 50, and restricts shareholders from publicly trading shares.

-

Continuity of existence

-

Larger amount of capital

-

Unity of direction

-

Efficient management

-

Limited liability

-

Digital Signatures of 7 Subscriberss

-

DIN of Directors

-

Filing of Spice form

-

Issue of Incorporation Certificate along with PAN and TAN

-

Memorandum of Association

-

Articles of Association

-

Provisional PF ESI Registration

-

GST Registration

-

MSME Registration

-

Pan Card of all Directors and Subscribers

-

Identity Proof i.e. Voter Id Card/ Driving License/ Aadhar Card/ Passport of all Directors and Subscribers

-

Address Proof i.e. Bank Statement, Mobile bill, Telephone bill of all Directors and Subscribers

-

Passport Size Photographs of all Directors and Subscribers

-

Current Electric Bill/ Utility Bill as Registered Office Proof

-

Rent Agreement if Applicable

NGO/Societies & Trust

Religious and Charitable Trusts in India

Social welfare is the basic responsibility of government. Charitable and Religious Trusts lessen this burden. Therefore, tax concessions are offered. Income applied for predefined and declared charitable object is exempt from income tax. Wealth tax is also not charged on properties held. If eligible, donors are also given deduction from income tax u/s 80G or section 80GGA. Skillful and Intelligent tax planner tends to use trust for evasion of taxes. This result in a plethora of regulatory measures. Consequently, the legislation has become confused and complicated. More so because the term like 'income', 'capital', 'capital gains', 'donations', etc., used informal tax parlance or even in ordinary parlance have entirely different meanings and connotations in the case of trusts.

-

Public charitable or religious trusts

Income from these trusts is applied to charitable or religious purposes.

-

Private trusts

The trust should get itself registered [Form No. 10A for Application] with the Commissioner of Income-tax within one year from the date on which the trust is created.

The accounts of the trust should be audited (Form No. 10B) for such accounting year in which its income exceeds Rs. 50,000.

-

Trust Deed

-

MoA of Trust

-

AoA of Trust

-

Trust Pan Card

-

Pan Card of all Directors and Subscribers

-

Identity Proof i.e. Voter Id Card/ Driving License/ Aadhar Card/ Passport of all Directors and Subscribers

-

Address Proof i.e. Bank Statement, Mobile bill, Telephone bill of all Directors and Subscribers

-

Passport Size Photographs of all Directors and Subscribers

-

Current Electric Bill/ Utility Bill as Registered Office Proof

-

Rent Agreement if Applicable

Business Registration

Business Registration provides more prominent visibility on your domain names Who is listing by letting you add a logo, business links, images, business hours, coupons, and even a local map that highlights your location.

You can only add Business Registration to domain names registered in your account with us. However, you can associate a Business Profile with any valid domain name, regardless of where it is registered

PAN

Permanent Account Number (PAN) is a code that acts as an identification for individuals, families and corporates (Indian and Foreign as well), especially those who pay Income Tax.

It is a unique, 10-character alpha-numeric identifier, issued to all judicial entities identifiable under the Indian Income Tax Act, 1961. The Income Tax PAN code and its linked card are issued under Section 139A of the Income Tax Act. It is issued by the Indian Income Tax Department under the supervision of the Central Board for Direct Taxes (CBDT) and it also serves as an important proof of identification.

It is also issued to foreign nationals (such as investors) subject to a valid visa, and hence that PAN is not acceptable as a proof of Indian citizenship.

TAN

TAN (Tax Deduction and Collection Account Number). It is issued by Income Tax Department of India to those individuals and firms who are required to deduct or pay tax on payments made by them, under the Income Tax Act, 1961. Under Section 203A of the Income Tax Department, it is mandatory to provide the TAN in all TDS returns and Challans while paying tax.

Professional Tax

Professional Tax is the tax charged by the state governments in India. Any one earning an income from salary or Business or any one practicing a profession such as chartered accountant, lawyer, doctor etc. are required to pay professional tax.

GST Registration

Goods and Services Tax (GST) is a destination based tax on consumption of goods & services. It is levied at all stages right from manufacture up to final consumption with credit of taxes paid at previous stages available as setoff. Only value addition will be taxed and burden of tax is to be borne by the final consumer. The tax would accrue to the taxing authority which has jurisdiction over the place of consumption which is also termed as place of supply.

Goods and Services Tax (GST) is an indirect tax (or consumption tax) levied in India on the supply of goods and services. GST is levied at every step in the production process, but is meant to be refunded to all parties in the various stages of production other than the final consumer.

The tax came into effect from July 1, 2017 through the implementation of One Hundred and First Amendment of the Constitution of India by the Indian government. The tax replaced existing multiple cascading taxes levied by the central and state governments.

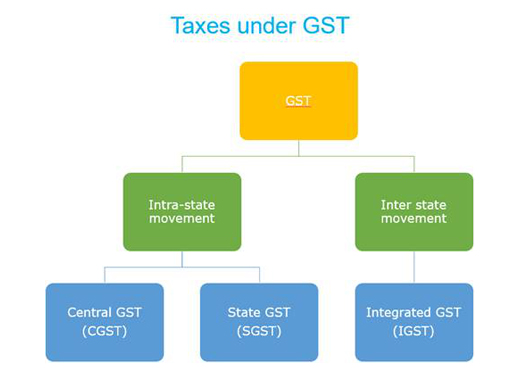

Unlike earlier when there were multiple taxes such as Central Excise, Service Tax and State VAT etc., under GST, there is just one tax. GST is categorized into CGST, SGST or IGST depending on whether the transaction is Intra-State or Inter-State.

The three type’s tax structure is implemented to help taxpayers take the credit against each other, thus ensuring

“One Nation, One Tax”.

To determine whether Central Goods & Services Tax (CGST), State Goods & Services Tax (SGST) or Integrated Goods & Services Tax (IGST). Will be applicable in a taxable transaction, it is important to first know if the transaction is an Intra State or an Inter-State supply.

Intra-State supply of goods or services is when the location of the supplier and the place of supply of the buyer are in the same state. In Intra-State transactions, a seller has to collect both CGST and SGST from the buyer. The CGST gets deposited with Central Government and SGST gets deposited with State Government.

Inter-State supply of goods or services is when the location of the supplier and the place of supply are in different states. Also, in cases of export or import of goods or services or when the supply of goods or services is made to or by a SEZ unit (Special Economic Zone), the transaction is assumed to be Inter-State. In an Inter-State transaction, a seller has to collect IGST from the buyer.

Under GST, Central Goods and Services Tax (CGST) is a tax levied on Intra State supplies of both goods and services by the Central Government and will be governed by the CGST Act. SGST will also be levied on the same Intra State supply but will be governed by the State Government.

This implies that both the Central and the State governments will agree on combining their levies with an appropriate proportion for revenue sharing between them.

Under GST, State Goods and Services Tax (SGST) is a tax levied on Intra State supplies of both goods and services by the State Government and will be governed by the SGST Act. As explained above, CGST will also be levied on the same Intra State supply but will be governed by the Central Government.

Note: Any tax liability obtained under SGST can be set off against SGST or IGST input tax credit only.

Under GST, Integrated Goods and Services Tax (IGST) is a tax levied on all Inter-State supplies of goods and/or services and will be governed by the IGST Act. IGST will be applicable on any supply of goods and/or services in both cases of import into India and export from India.

Note: Under IGST, Exports would be zero-rated. Tax will be shared between the Central and State Government.

-

Consultation for GST Requirement

-

Preparation of Documents

-

Application Filing

-

GST Certificate and Login Credentials

-

PAN of the Applicant

-

Aadhaar card

-

Proof of business registration or Incorporation certificate

-

Identity and Address proof of Promoters/Director with Photographs

-

Address proof of the place of business

-

Bank Account statement/Cancelled cheque

-

Digital Signature in case of Company

Karnataka Shops and Commercial Establishment

Shops: 'shops' means any premises where any trade or business is carried on or where services are rendered to customers and includes offices, storerooms, godowns, warehouses, whether in the same premises or otherwise, used in such connection with such trade or business, but does not include a commercial establishment or a shop attached to a factory.

Commercial Establishment: Commercial Establishment means a commercial or trading or banking or insurance establishment, an establishment or administrative service in which persons employed are mainly engaged in office work, a hotel, restaurant, boarding or eating house, a café or any other refreshment house, a theatre or any other place of public amusement or entertainment.

Establishments Act, 1962 (here onwards to be referred as, the Act) is an act that provides for the regulation of conditions of work and employment in shops and commercial establishments. The following article covers the three aspects of the Karnataka Shops & Commercial Establishments Act, 1962.

MSME Registration

The Government of India has enacted the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006 in terms of which the definition of micro, small and medium enterprises is as under:

Enterprises engaged in the manufacture or production, processing or preservation of goods as specified below

-

A micro enterprise is an enterprise where investment in plant and machinery does not exceed Rs. 25 lakh.

-

A small enterprise is an enterprise where the investment in plant and machinery is more than Rs. 25 lakh but does not exceed Rs. 5 crore.

-

A medium enterprise is an enterprise where the investment in plant and machinery is more than Rs.5 crore but does not exceed Rs.10 crore. In case of the above enterprises, investment in plant and machinery is the original cost excluding land and building and the items specified by the Ministry of Small Scale Industries vide

ESI Registration

Employee's State Insurance (abbreviated as ESI) is a self-financing social security and health insurance scheme for Indian workers. This fund is managed by the Employees' State Insurance Corporation (ESIC) according to rules and regulations stipulated there in the ESI Act 1948. ESIC is an autonomous corporation by a statutory creation under Ministry of Labour and Employment, Government of India.

Proper registration under the ESI scheme of ESIC, is referred to as the ESI Registration. Registration under this ESI scheme ensures availability of a wide-range of medical, monetary, and other benefits to the employees of any employing entity having 10 or more employees. Such facilities are indeed very elegant for improving and boosting the health, morale, performance, and retention and progress of employees. Thus, registration under ESI scheme is regarded as a statutory responsibility of every concerned employer entity, engaged in any economic field.

Provident Funds

A retirement plan for the private and public sectors in Malaysia, enacted by the Employees Provident Fund (EPF) Act of 1991, intended to help employees save a portion of their salary in the event of retirement, disability, sickness or unemployment. As of 2007, employees are required to contribute at least 11% of their paycheck, with their employers contributing at least an additional 12%. The savings can then be used by the EPF for a wide variety of investments, and the participating employees are repaid through reinvested dividends. Employees may withdraw 30% of their accumulated EPF savings at age 50, and 100% at age 55.

Provident fund is another name for pension fund. Its purpose is to provide employees with lump sum payments at the time of exit from their place of employment. ... Employees' Provident Fund Organization, India's retirement plan.

This differs pension funds, which have elements of both lump sum as well as monthly pension payments. As far as differences between gratuity and provident funds are concerned, although both types involve lump sum payments at the end of employment.

-

Consultation for PF Requirement

-

Preparation of Documents

-

Application Filing

-

PF Certificate and Login Credentials

-

Registration Certificate i.e GST Certificate, Shop and establishment, COI

-

Address proof i.e Electricity Bill, Rent agreement, Telephone Bill, Water bill

-

PAN card of business entity and all partners/directors

-

Cancelled cheque

-

Digital Signature

-

Bank Account statement/Cancelled cheque

-

MOA/ AOA of Company

Firm Registration

A Partnership is defined by the Indian Partnership Act, 1932, as 'the relation between persons who have agreed to share profits of the business carried on by all or any of them acting for all'. The business must be carried on by all the partners or by any of them acting for all of them.

Partnership comes into existence by an agreement between two or more persons called partners. The Indian Partnership Act, 1932 makes provision for registration of firms but registration is not compulsory in India. As registration is not compulsory, unregistered firm is not treated as an illegal association. Registration of partnership arises because it safeguards the legitimate rights and obligations of parties in case of disputes and disagreements.

Registration Procedure: A partnership firm can be registered whether at the time of its formation or even subsequently. You need to file an application with the Registrar of Firms of the area in which your business is located.

Digital Signature

A digital code (generated and authenticated by public key encryption) which is attached to an electronically transmitted document to verify its contents and the sender's identity.

-

For e-filing of the income tax returns by any individual, the Government of India has made it mandatory to affix digital signatures to the income tax returns documents. For affixing the digital signature one must have digital signature certificates issued by licensed certification authority.

-

In addition, Ministry of Corporate Affairs has set the mandatory guidelines for the companies directing them to file all reports, applications and forms using a digital signature only and this again requires a digital signature certificate.

-

For GST also a company must verify its GST application by affixing a digital signature using digital signature certificate in order to get registered for GST.

-

These days many Government procedures, filling different applications, amendments and forms require digital signatures made by using digital signature certificates.

Licenses

Import Export Code (IEC)

-

Import Export Code (IEC) Registration is required by a person who's want to start import export business in India. IEC Code is issued by the Director General of foreign trade (DGFT). It’s a 10 digit code with a lifetime validity.

-

Import Export Code is required in following situation :

- When importers have to clear the shipments from the customs.

- When importers send the money to abroad via banks then it's required by the banks through SWIFT Code.

- When exporters have to send the shipments then it’s required by the customs port

- When exporters received the money in foreign currency directly into the bank then it’s needed by the banks

-

International Exposure: IEC Code helps you to grow your business from local market to international market and expand your product or service across the globe.

-

Government Benefits: Govt of India always promote the export activity in India so through IEC Code Registration you can avail all the export scheme benefits from DGFT, Customs and Export Promotion Council.

-

No Renewals : IEC Code issued by the DGFT for the lifetime validity so you have not required renew every year so it’s a just one time cost of the registration.

-

No Annual Compliance: IEC Code have no annual compliance like returns filings etc. Even you have not shown anywhere the transactions.

-

Individual person: IEC Code can be obtain by the individual person also, they have not required to register the legal entity.

-

One who is exporting or importing goods for personal use and not for business manufacture or agriculture.

-

One who is exporting or importing from or to Nepal or Myanmar which should not exceed Rs 25,000 in single assignment and should be through Indo-Myanmar border areas.

-

Ministries or the department of central government or state government.

-

Drafting Docs

-

Preparation of Application

-

Application Filing

-

Paying Government Fees

-

Pan Card of the Company /LLP or Firm

-

Cancelled Cheque of Applicant

-

Certificate of Incorporation, MOA & AOA

-

PAN Card of All Directors/ Partners

-

Id and Address Proof of All Persons

Drug License

Drug License is a permission from the government to deal with drugs. There are two kinds of license, the retail license and wholesale license of for drug distribution or sale in India. This license is issued subject to certain conditions attached to premises and competent person who shall be dealing with drugs.

Drug Control Organization issues two types of licenses

-

Retail Drug License (RDL)

-

Wholesale Drug License (WDL)

RDL is issued to run a general chemist shop. WDL issued to agencies engaged in wholesale of drugs and medicines.

-

Consultation for Type of license required

-

Preparation of Documents

-

Application Filing

-

Paying Government Fees

-

Drug License

-

Constitution of the firm (MOA/AOA)

-

Photo ID proof of proprietor/partner/director

-

Copy of Property paper (If owned property)

-

Copy of Rent agreement (If rented property)

-

Site Plan and key plan of the premises

-

Refrigerator invoice and details

-

Affidavit regarding compliance of MPD 2021 (if premises are located on DDA residential flat/ plot/ building)

Food/FSSAI License

FSSAI license is mandatory before starting any food business. FSSAI registration is an abbreviation used for Food Safety and Standards.

Food Safety and Standards Authority of India (FSSAI) is an autonomous body established under the Ministry of Health & Family Welfare, Government of India.[4] The FSSAI has been established under the Food Safety and Standards Act, 2006 which is a consolidating statute related to food safety and regulation in India.[4] FSSAI is responsible for protecting and promoting health through the regulation and supervision of food safety.

-

Consultation for Type of license required

-

Preparation of Documents

-

Application Filing

-

Paying Government Fees

-

Copy of Aadhaar Card/ Voter identity card of Proprietor/ Partners/ Director

-

Certificate of Incorporation & MOA

-

PAN Card and Expected Turnover

-

Premises Proof with NOC from Owner

-

Photographs of Promoters/Partners

-

PAN Card of Each Promoter/Partners

-

Identity Proof of Promoter/Partners

Trade / BBMP License

A trade license is a document/certificate that gives the permission to the applicant (person seeking to open a business) to commence a particular trade or business in a particular area/location. However, the license does not allow the holder to any other trade or business than for it is issued. Furthermore, this license does not pass on any kind of property ownership to the holder of the license.

-

Industries license: small, medium and large scale manufacturing factories

-

Shop license: Dangerous and Offensive trades like a sale of firewood, cracker manufacturer, candle manufacturer, barber shop, dhobi shop etc.

-

Food establishment license: Restaurants, hotels, food stall, canteen, the sale of meat & vegetables, bakeries etc.

-

The applicant must have crossed the age of 18 years

-

The applicant must not have any criminal records

-

Business must be legally permissible.

In Bangalore, BBMP is the civic agency that issues trade licences to various shops and industries within its jurisdiction. The Health Department of BBMP is in charge of these matters. The health officer of BBMP has powers to close an unlicensed commercial premise. The licence issued expires on 31st March every year.

-

Consultation

-

Preparation of Documents

-

Application Filing

-

Trade License and Login Credentials

-

Certificate of Incorporation/ Partnership Deed/ MSME

-

MOA / AOA of Company

-

Pan Card of Company

-

Id and Address Proofs of Partners

-

Number of Employees

-

Cancelled Cheque

-

Electric Bill for Registered Office Proof

Factory License

Factory Licence:The factory owners are required to notify and also register their premises with the local governing authority before the beginning of operations. This helps in facilitating the risk management at workplace and the total implementation of Safety and Health Management Systems in factory premises.

“Factory” Under the Factories Act, 1948 means:-

-

Any premises including the precincts (A Place enclosed with walls or fences) thereof.

-

In any part of which a manufacturing process is being carried on.

-

Where on any day of the preceding twelve months.

-

Whereon TEN OR MORE WORKERS are working, or were working in any part of a MANUFACTURING PROCESS BEING CARRIED ON WITH THE AID OF POWER.

-

Whereon TWENTY OR MORE WORKERS are working in any part of a MANUFACTURING PROCESS IS BEING CARRIED ON WITHOUT THE AID OF POWER.

-

For this clause, the mere fact that an ELECTRONIC DATA PROCESSING UNIT OR A COMPUTER UNIT IS INSTALLED in any premises or part thereof, shall not be construed to make it a factory IF NO MANUFACTURING PROCESS IS BEING CARRIED on in such premises or part thereof.

-

But “Factory” does not include:

- A mine subject to the operation of , The Mines Act, 1952 (35 of 1952)], or

- A mobile unit belonging to the armed forces of the Union or

- Railway running shed or a hotel, restaurant or eating place.

Intellectual Property

Trade Mark

A trademark is a unique identifier, often referred to as a “brand” or “logo”. Once a trade mark is registered, the ® symbol may be used with the trademark. A Trademark is thus an intangible property of its owner and the owner has the authority to enforce it in the case of unlawful uses. A Trademark can be in various forms like Logos, Words, Shapes, Sounds and Smells-or any combination of these

-

Trademark makes you proprietor of the brand.

-

You can stop others from copying your products.

-

Trademarks are an effective communication tool

-

Trademarks make it easy for customers to find you.

-

Trademarks are a valuable asset.

-

Consultation for Brand Name

-

Preparation of Trademark Application

-

Application Filing

-

Paying Government Fees

-

Proof of Applicant

-

PAN Card and Address Proof of Applicant

-

Certificate of registration (other than an Individual applicant)

-

Brand Name & Logo

-

MSME / Start-up Recognition

-

Proof of TM Use

Copy Right

Fundamentally, copyright is a law that gives you ownership over the things you create. Be it a painting, a photograph, a poem or a novel, if you created it, you own it and it’s the copyright law itself that assures that ownership. The ownership that copyright law grants comes with several rights that you, as the owner, have exclusively. Those rights include:

-

The right to reproduce the work.

-

to prepare derivative works

-

to distribute copies

-

to perform the work

-

and to display the work publicly

These are your rights and your rights alone. Unless you willingly give them up (EX: A Creative Commons License), no one can violate them legally. This means that, unless you say otherwise, no one can perform a piece written by you or make copies of it, even with attribution, unless you give the OK

-

Consultation

-

Preparation of Copyright Application

-

Application Filing

-

Paying Government Fees

-

Issuance of Dairy Number

-

Name, Address & Nationality of the Candidate – ID proof

-

NOC from the publisher if work published and publisher is different from the applicant

-

Search Certificate from Trade Mark Office (TM -60) if any

-

NOC from a person whose photograph appears on the work

-

Power of Attorney

-

2 Copies of work

-

KYC of author

-

DD/IPO of Rs. per work (as applicable)

-

NOC from the author if the candidate is different from the author

Patent

A patent in an exclusive right granted by a country to the owner of an invention to make, use, manufacture and market the invention, provided the invention satisfies certain conditions stipulated in the law. Exclusivity of right implies that no one else can make, use, manufacture or market the invention without the consent of the patent holder. This right is available only for a limited period of time. A patentee must disclose the invention in a patent document for anyone to practice it after the expiry of the patent or practice it with the consent of the patent holder during the life of the patent.

-

Art, Process, Method or Manner of manufacture.

-

Machine, Apparatus or other Articles

-

Machine, Apparatus or other Articles

-

Machine, Apparatus or other Articles Computer Software which has Technical application to Industry or is used with Hardware

-

Product Patent for Food / Chemical / Medicines or Drugs.

-

Frivolous or obvious inventions.

-

Inventions which could be contrary to law or morality or injurious to human, animal or plant life and health or to the environment.

-

Mere discovery of the scientific principle or the formulation of an abstract theory or discovery of any living thing or non-living substances occurring in nature.

-

Mere discovery of any new property or mere new use for known substance or the mere use of a known process, machine or apparatus- unless results to new products or employs one new reactant.

-

Producing a new substance by mere admixtures of substances.

-

Mere arrangement / rearrangement or duplication of known devices functioning independently.

-

Method of agriculture and horticulture.

-

• Any process for the medicinal or surgical, curative prophylactic, diagnostic, therapeutic or other treatment of human beings, animals to render them free of disease or to increase their economic value or that of their products.

-

The biological processes for production or propagation of plants and animals in whole or any part thereof other than micro-organisms but including seeds, varieties and species (new plant varieties can be protected by the protection of plant varieties and farmers act 2001).

-

A mathematical or business method or algorithms.

-

A Computer Programme per se other than its technical application to industry or a combination with hardware.

-

Aesthetic creation including cinematography and television production.

-

Method for performing mental act or playing game.

-

Presentation of information.

-

Topography of Integrated Circuits.

-

Invention which in effect, is traditional knowledge or which is an aggregation or duplication of known properties of traditionally known components.

-

Inventions relating to Atomic Energy.

ISO

International Organization for Standardization (Organisation Internationale de generalisation in French), which is often called ISO, is an international standard-setting organization formed from representatives of standard organizations of various nations. It was established on February 23, 1947, to declare global industrial and commercial standards. Its headquarters are located in Geneva, Switzerland.

ISO has published 22306 International Standards and related documents, covering almost every industry, from technology to food safety, to agriculture and healthcare. ISO International Standards impact everyone, everywhere.

-

Consultation for Type of ISO Required

-

Preparation of Documents

-

Application Filing

-

ISO Certificate

-

Business Registration Proof

-

KYC of Proprietor/Partners/Directors

-

Objectives of Business

-

Email Id and Phone Number

-

Current Electricity Bill